Film & TV Tax Incentives

CALL TO ACTION!

WE NEED YOUR HELP!

Testify to SAVE our industry! Fight HB 5110 to ELIMINATE FILM PRODUCTION TAX CREDIT

What and When: PUBLIC HEARING AGENDA Wednesday, March 20th.

We need everyone there. Please show up early and get your Free T-Shirt to wear to make sure the Lawmakers pay attention and show your support for the Film Industry in Connecticut!

Where and what time : Wednesday the 20th, at 10:00 AM in Room 2E of the The Legislative Office Building (LOB) Address: 300 Capitol Ave #5100, Hartford, CT 06106

WE NEED TO CONVINCE THE

Finance, Revenue and Bonding Committee to VOTE NO on Proposed H.B. No. 5110 AN ACT ELIMINATING THE FILM PRODUCTION TAX CREDIT

THIS PROPOSED BILL WOULD COMPLETELY ELIMINATE CONNECTICUT’S FILM TAX PROGRAM. WE CANNOT LET THAT HAPPEN.

We now have a bill in front of the Connecticut Finance Committee ELIMINATING FILM PRODUCTION TAX CREDIT.

They are holding a hearing Wednesday, March 20th on Bill H.B. No. 5150 AN ACT ELIMINATING FILM PRODUCTION TAX CREDIT in Room 2E of the Legislative Office Building in Hartford. We are hoping you will show up and testify!

THIS OUR LAST CHANCE TO SAVE OUR TAX CREDIT. Everyone needs to pitch in to protect our industry and our jobs. We need to tell our personal stories and convince the lawmakers on the Finance Committee that it is extremely important to not eliminate our film tax credit as it would decimate our industry in the state.

We are asking you to submit testimony either in person or via Zoom and/or written testimony. You can submit testimony or sign up via these links:

To register to speak, click this link, follow the prompts to register for the hearing and note your preference to testify in person or remotely.

LINK: Virtual/In-Person Testimony: https://zoom.us/webinar/register/WN_7OZmNmxVSAqHicpM3LiZDw#/registration

Once you fill out the form, if you are planing on testifying in person, please note they will also give you a Zoom link as a back up so if for any reason you can’t make it, you will be able to testify virtually. Also parking is free and there is a cafeteria in the building. Please be aware it will be a long day (much like being on set, as the hearing is a live broadcast on TV).

Helpful link for testifying in Connecticut: Testifying at a Public Hearing

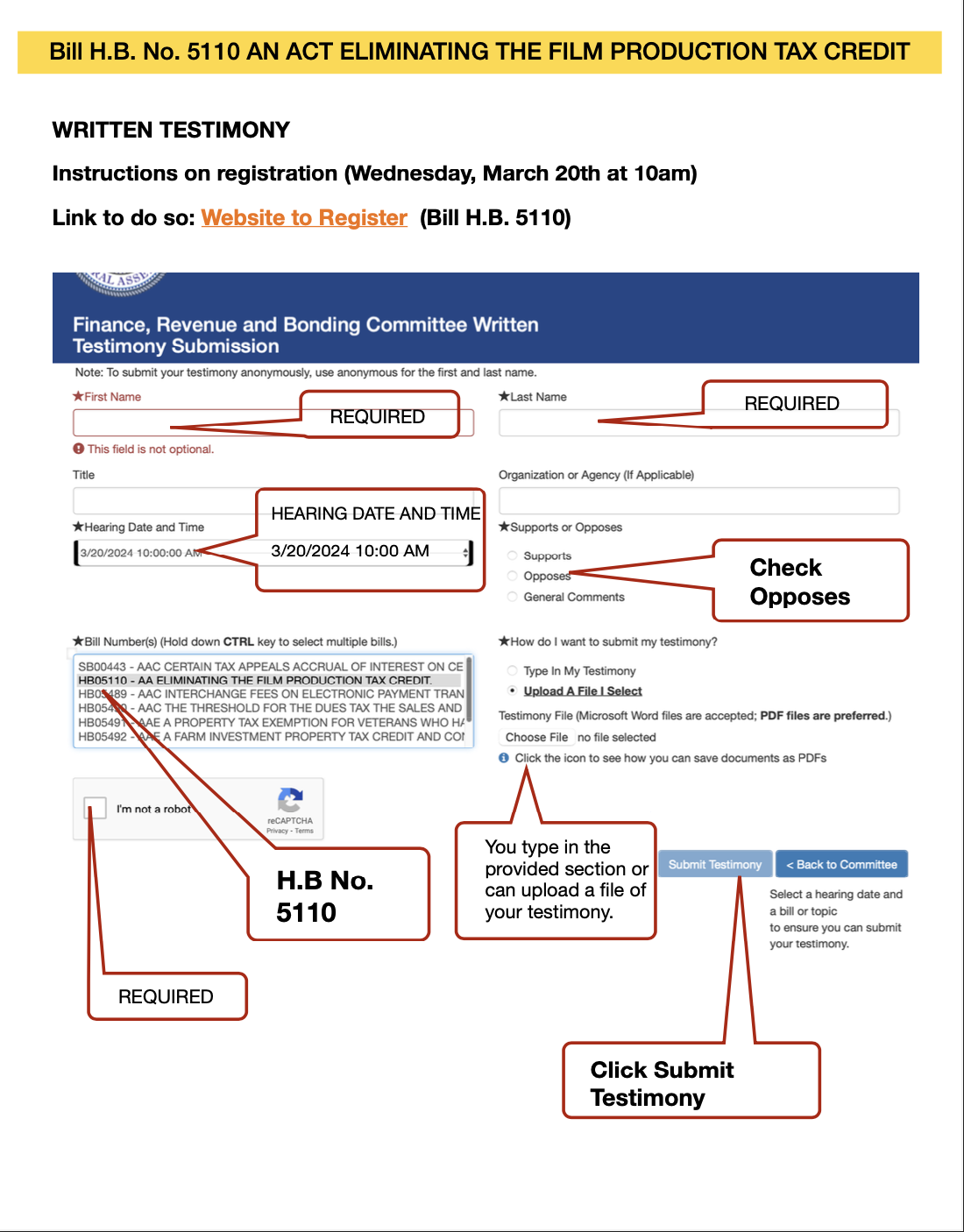

Even if you are planning on testifying in person or virtually, you still need to summit written testimony. To do this:

Follow the prompts in the form and select Wednesday, March 20th, 10:00 am hearing date and hold down the shift key to select H.B. No.5110 for the bill number. Select that you OPPOSE the bill. Upload a written document for your testimony or write a short statement in the box provided. Don't forget to click your OPPOSITION to the bill, verify that you are not a robot, and hit “Submit Testimony.”

LINK: Written Testimony: https://www.cga.ct.gov/aspx/CGATestimonySub/CGAtestimonysubmission.aspx?comm_code=FIN

We are asking you to use YOUR OWN WORDS as the Committee may be deleting emails that are "copied and pasted." However, here are a few important points that you can incorporate into your testimony:

1. Tell your personal story: How the elimination of the film tax credit and ensuing loss of jobs and business will affect you. Also mention what it means to you on a personal level to have film and TV jobs available in the state.

2. Give specific examples of positive economic impact that has resulted from film and TV production: How you have personally experienced and seen positive economic impact in your local community.

3. Mention the following points that we are pushing forward to protect our industry in the future:

a. Bringing Back the Film Commission: Restoring the Connecticut Film Commission will provide essential support, information and resources for lawmakers, state agencies and filmmakers to help with management of the film and TV tax incentive programs.

b. Lifting the Moratorium on Theatrical Films: Currently, theatrical films do not qualify for Connecticut’s tax incentive. By lifting the moratorium on theatrical film production, we will be able to maximize the opportunities to being more productions and job opportunities to the state. This would be in line with the deep changes to the entertainment industry, as there will be a anticipated 45% reduction in television production and a massive move to produce more feature films geared toward theatrical release.

c. Proposing the Change of Tax Credits to Film Rebates: Transitioning from tax credits to film rebates will make Connecticut a more attractive destination for filmmakers, encouraging investment in local communities and infrastructure, without costing the state a single cent more. It would be a clean and efficient way to bring more productions to the states. We will have the most competitive film and TV incisive programs in the country, beating New York, New Jersey, and even Georgia.

d. Working with UCONN and state schools with their film and Television Programs and Sound Stages: Collaborating with local institutions to develop training programs and establish sound stages will cultivate a skilled workforce in the state and provide filmmakers with the resources they need to succeed without having to bring in talent from out of state.

A link to the bill H.B. No. 5110: https://www.cga.ct.gov/asp/cgabillstatus/cgabillstatus.asp?selBillType=Bill&bill_num=HB05110&which_year=2024.

Please take action and submit testimony, and sign up to testify in person if you can, and virtually if you can’t. We need everyone to come together and fight for our industry in the state!